Hold a range of assets that can be easily and quickly settled within our custody, providing smooth on- and off-ramps for digital instruments and cash.

As a Qualified Custodian, BitGo's Trust Company offers financial institutions enterprise-grade, multi-layer security. Our compliance program includes robust KYC and AML policies and procedures that leverage various data sources, such as watchlists, fraud databases, and document verification services.

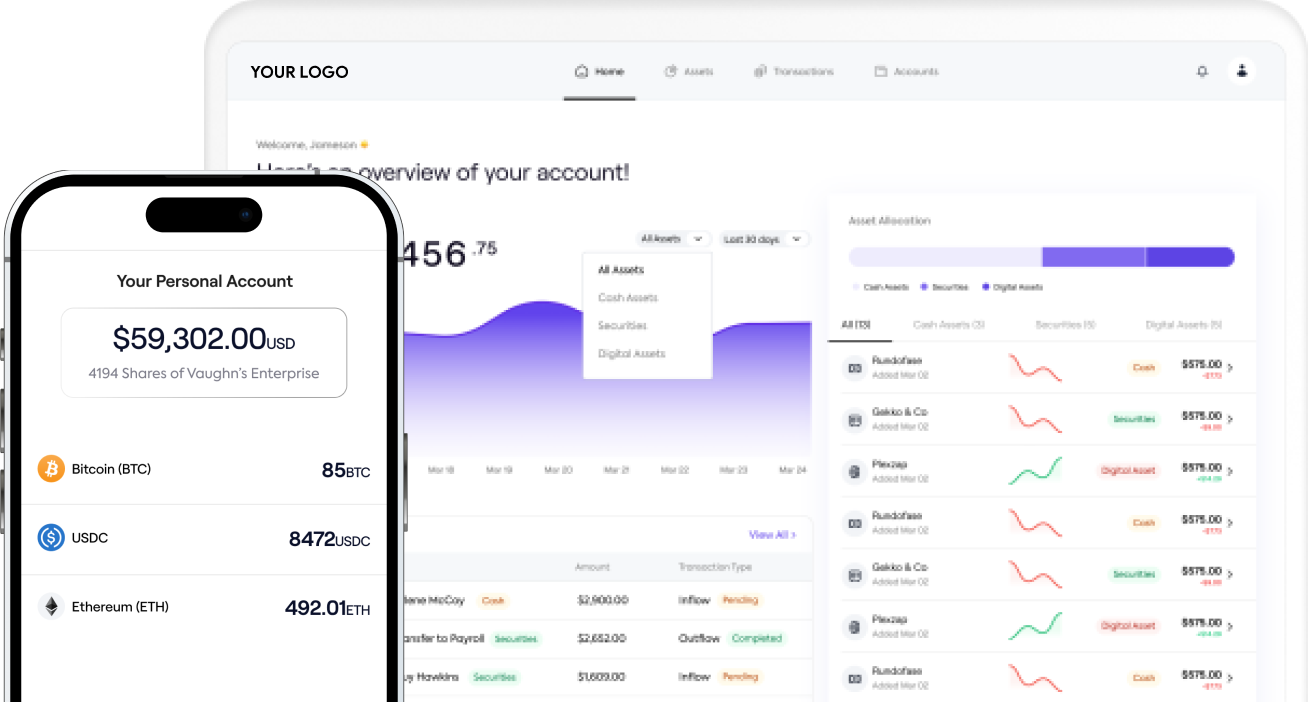

Various Asset Types

Securely and compliantly hold cash, private securities, digital assets, and other alternative assets.

Qualified Custodian

As an independent, qualified Custodian, we are the industry's trusted provider of secure storage solutions for traditional and modern assets.